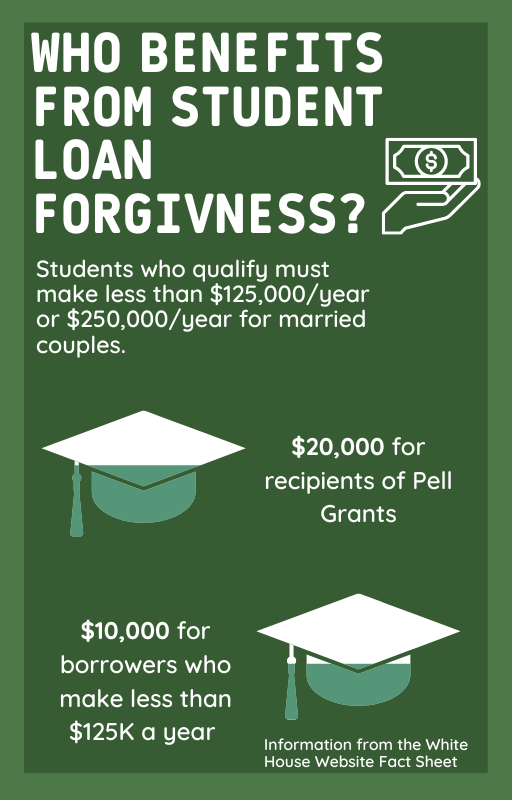

President Biden’s Student Debt Plan

On Aug 24, 2022 President Joe Biden announced a plan to relieve student debt for low-income citizens of the United States.

The proposed plan would give up to $20,000 to students that qualified for a Pell grant loan, a type of loan given to low-income students to help pay for college, and up to $10,000 to students that did not qualify for Pell grant loans. Both of these options are only offered to borrowers that make less than $125,000 per year or $250,000 per year for married couples.

This means that no one in the top 5 percent of earners in the US will receive aid from this plan; they will keep paying off their student loans as they have been in the past.

To get the relief offered in this plan, most borrowers, though not all, will have to fill out an application, which has not been opened yet, that you can find on the White House website.

The White House is working with the US Department of Education to not only forgive debt for college graduates but also make college more affordable for current students.

LHS Postsecondary Counselor Erinn Murphy said, “The maximum Pell grant amount for [the class of 2023] is $6,895, which went up $400 from last year.”

This will likely not have a large impact on students at LHS. Ms.Murphy stated, “For Libertyville, I think we have a really strong college-going culture that’s built-in.” This means that for many students, their decisions about what to do after high school will likely not change to include college.

The last major thing that this bill does is continue the student loan repayment freeze, which started in March of 2020 during COVID, for what the White House says is the last time. Student loans have not needed to be paid back over the past two years, and this will continue until Dec 31, 2022.

This plan will likely affect former students that are under large debt burdens or students in the future when more concrete plans for college affordability have been made.

![Mr. Abullh Ali, manager/assistant, helps open Queen Yemeni Coffee in downtown Libertyville at 606 North Milwaukee Ave. With the help of employees such as manager and LHS senior Yousef Taha, they are able to bring the Yemeni and Ethiopian culture to Libertyville by using their Queen spices, cinnamon and cardamom in their drinks such as Adani Chai, which is inspired by Sheda, the Queen of Yemen and Ethiopia. “The history of our coffee [is] a long history and we believe that Yemen and Ethiopia started the coffee and we are bringing something unique to the community,” Mr. Ali said.](https://www.lhsdoi.com/wp-content/uploads/2025/04/Photo-1-600x400.jpg)